Fair Tax Act 2025 Pros And Cons

Fair Tax Act 2025 Pros And Cons. Let us see some of its pros and cons. It would take almost every federal tax and replace them with a fat 30 percent sales tax on everything.

Simplified tax system by replacing multiple taxes with a single national sales tax. Employers will commit an offence if:

Fair Tax Act 2025 Pros And Cons Images References :

Source: www.youtube.com

Source: www.youtube.com

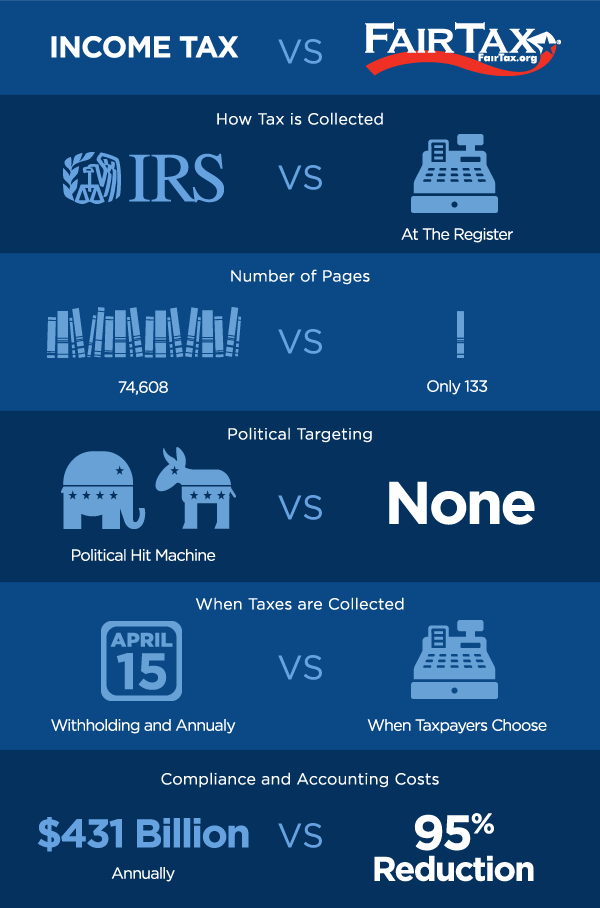

HOUSE TO VOTE ON BILL TO ABOLISH THE IRS PROS AND CONS OF THE NEW, The fair tax system is a tax system that eliminates income taxes (including payroll taxes) and replaces them with a sales or consumption tax.

Source: eatthestate.org

Source: eatthestate.org

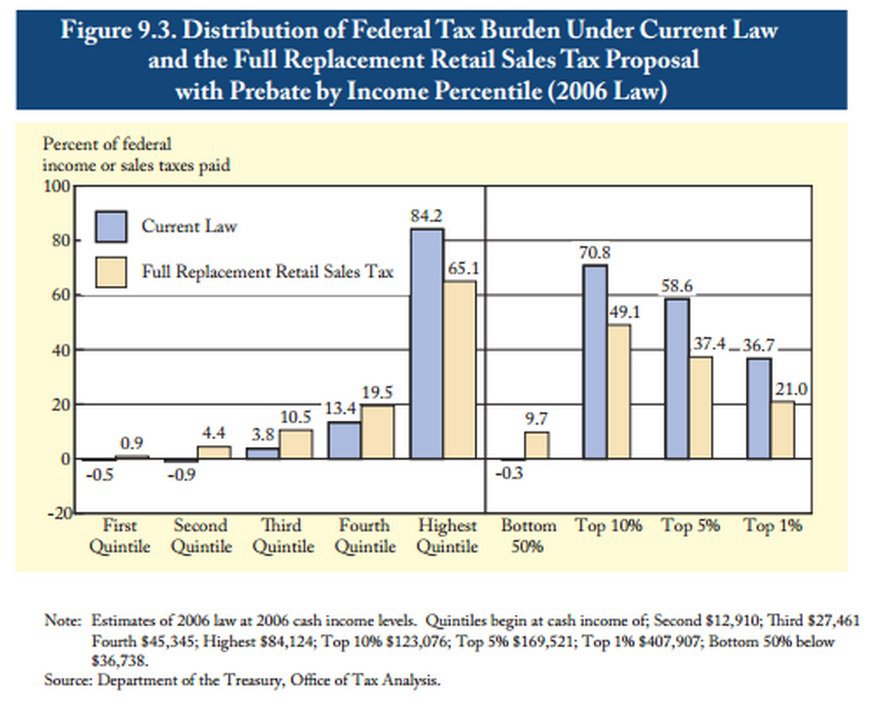

Pros and cons of the Fair Tax Act, This bill imposes a national sales tax on the use or consumption in the united states of taxable property or services in lieu of the current income.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

The Trouble with the FairTax Tax Policy Center, Employers will commit an offence if:

Source: www.emorydunahoo.com

Source: www.emorydunahoo.com

The Fair Tax in, List of the pros of a fair tax system.

Source: www.gafairtax.org

Source: www.gafairtax.org

10 Reasons to Support FairTax for FairTax, By imposing a single sales tax rate on purchases, not unlike what we currently pay at the state level, there would be no need to file.

Source: childtaxinfo.netlify.app

Source: childtaxinfo.netlify.app

26++ Il fair tax act pros and cons ideas in 2021 childtaxinfo, Few republican lawmakers have publicly supported a bill to replace most federal taxes with a national sales tax, a plan that has almost no chance of becoming law, or even.

Source: www.slideshare.net

Source: www.slideshare.net

Fair Taxation, The positive of this bill is its simplicity.

Source: www.youtube.com

Source: www.youtube.com

A Fair and Efficient Tax System for All YouTube, The bill proposes a 23% national tax rate for the 2025 tax year on gross payments for taxable property and services.

Source: margcompusoft.com

Source: margcompusoft.com

Understanding Section 92B of the Tax Act Preventing Transfer, List of pros of fair tax act.

Source: www.youtube.com

Source: www.youtube.com

Fair Tax Act Should you change your tax strategy? YouTube, To ease the burden on.